The Elderly Are Vulnerable

So, I recognize that the elderly are quite vulnerable to scamming and people trying to take advantage of them. That is pretty common knowledge, and I thought I had at least some working knowledge of the types of things that are being perpetrated on the elderly.

Then I started researching for this blog. Boy, is it dangerous out there! The resources listed at the bottom of this blog are just the tip of the rabbit hole I went down, and I ended up angry on behalf of the multitude of seniors who are susceptible to these tricks and schemes every day. I think about seniors who live alone or in facilities, making them even more likely to believe a fast-talking salesperson.

I thought this would be a good topic, since I dealt with a little taste of this when Mom had mild dementia, when I was first noticing some disturbing things. It became progressively worse as time passed, culminating with me taking her phone and wallet so she wouldn’t give in to any suggestive people or advertisements.

There is no doubt about it: The elderly are vulnerable. None more vulnerable than a dementia patient.

Let’s talk about some of the most common tactics, and how you can keep your loved one as safe as possible.

Common Scams

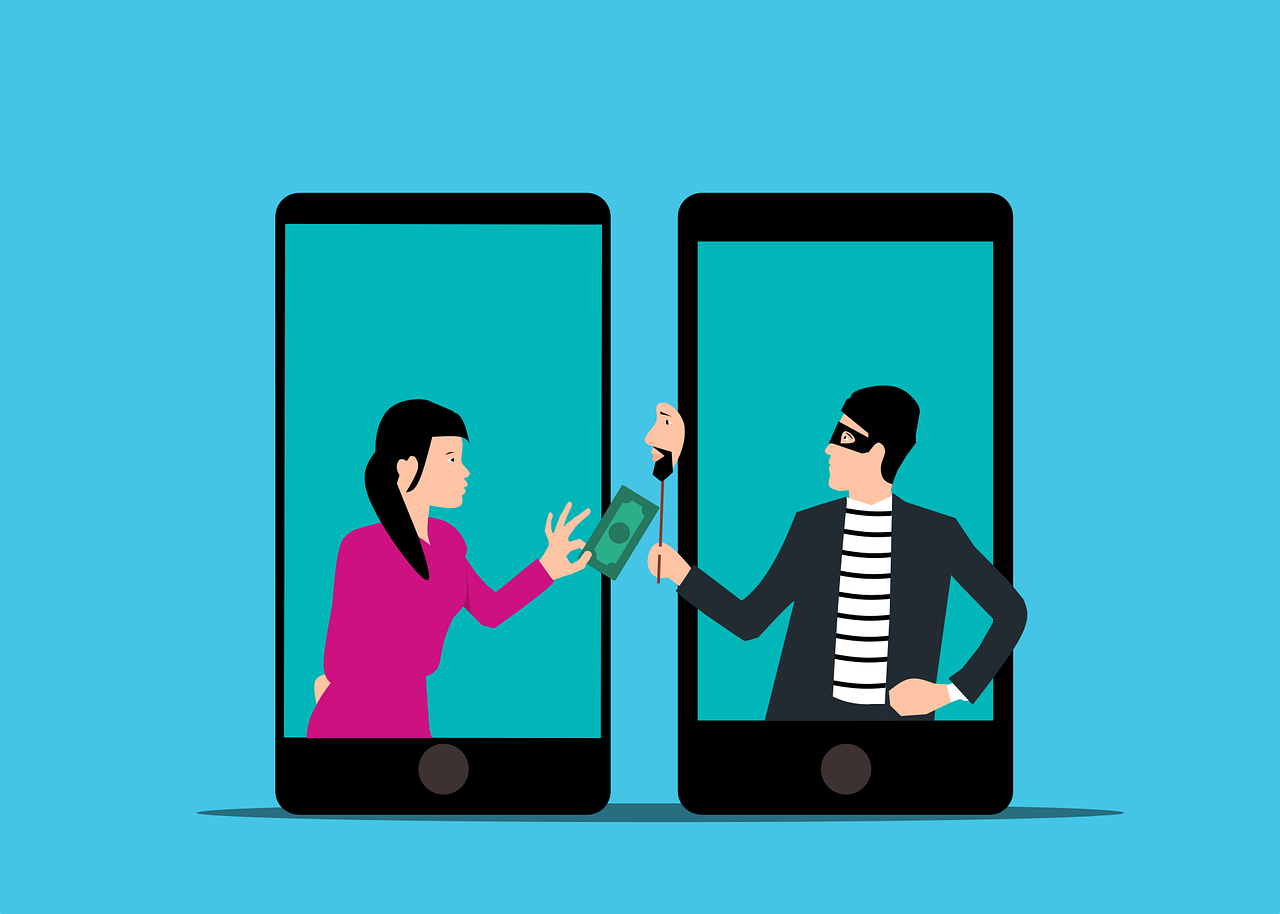

Relationship scams

Because of the intense loneliness many senior citizens feel, this is the most painful of the scams I found. Scamming the elderly is already heartbreaking, but this takes it to a new level.

People impersonating relatives and family members, plus people trying to exploit the loneliness of seniors ranks about as low on the totem pole as possible. Calls about relatives in trouble, grandchildren needing money, people needing your social security number, are very worrisome. Targeting that loneliness, romance scams are also quite popular, and equally distasteful. These telephone-based scams are particularly hard for those of you doing The Job from afar, since you can’t take away the telephone to minimize these problems.

Sweepstakes and prize scams

Capitalizing on the financial insecurity so many of our senior citizens face, people use the telephone or the internet to solicit money for these fake opportunities. Wanting to help the family by potentially improving their own situation, many seniors agree to share credit card or personal information for these scams.

Government imposter scams

These phone calls and emails go straight to the heart of seniors’ desires to be good citizens. When faced with potential fines, even jail time, seniors will often share sensitive information with the scammer to alleviate any potential trouble. This is particularly common with scammers using Medicare or Social Security fronts, since today’s seniors are completely dependent on those programs.

Robocalls and phishing scams

This type, including tech support scams and Ponzi schemes focusing on fake investments, are particularly difficult for seniors. Most seniors do not understand exactly what the scammer is saying, having less information about technology in general, and will fall prey to these types of scams because they think they need the “added protection” that these people are offering. Talking fast and using highly technical vocabulary are some of the tools these scammers use to confuse seniors until they agree to whatever product they are peddling.

Common Products Targeted To The Elderly

So scammers absolutely suck, especially when they’re scamming the elderly. Here’s the thing—I never had a problem with scammers with either of my parents. The ongoing problem I had was the relentless advertising of products that targeted Mom’s fears about getting older, losing her money, and being alone. These insidious commercials are completely legal—and incredibly painful:

Additional insurance

Your elderly loved one probably has Medicare/Medicaid. Hopefully they have a supplemental insurance policy, because Medicare certainly doesn’t cover everything. What they don’t need, however, is some has-been Hollywood hunk telling them what additional insurance they need! Mom has the best insurance imaginable with Tricare for Life retired military insurance—she doesn’t need anything else! It didn’t stop her, though, from calling me into the den repeatedly so that she could call and get additional insurance—at a quite hefty price I might add.

Assistive devices

Medicare covers the bulk of the costs for assistance devices, and they cover good quality merchandise, too. I haven’t had any trouble getting a wheelchair for Pop, walkers for Mom or items to make their bathroom safer for them. What they don’t need are those uber-expensive, high-tech and high cost products they see on the television. Nobody needs a heated wheelchair, people, nobody!!!

Places to live

One time, some hunky octogenarian convinced Mom she needed to move to a senior apartment development. She lived with us quite comfortably in two bedrooms and a bathroom for years, and hadn’t lived in an apartment since she was 21 years old! But this beautiful, fancy commercial convinced her that she would be happier, healthier and more secure in a sterile apartment complex miles from me. It was tough talking her off that ledge, that’s for sure.

Financial assistance

Mom never, ever handled the finances. Pop and I tried to teach her years ago, just for this purpose, but she was quite resistant to ever learning anything about where the money was and how it would be distributed. In recent years, however, she has been convinced—by official-looking professionals on television—that she needs outside help with her finances. At quite the consultation fee, too.

How Do You Keep Them Safe?

Monitor their television consumption

Since I have monitored the mail for years, all of these “offers” came to Mom primarily by television. Since she watches television almost non-stop, it became important for me to find a way to satisfy her need for entertainment and my need for peace. Enter Turner Classic Movies (TCM). She can’t manage a streaming service, so if your senior is in this situation, pay for cable to get this totally commercial-free station that only shows older movies. Scamming the elderly comes from all angles, and it’s up to us to monitor it.

Oversee any technology usage

Ultimately, I had to take the telephone. She always had trouble working it, and it just became something used only by scammers and opportunists. Mom didn’t even mind losing the phone, and almost never asks for it now. The only inconvenience is that my siblings need to call my cell to chat with Mom, but that is a very small inconvenience compared to what was happening.

Keep a close eye on that credit card

Once, and only once, Mom ordered something off of the television. This was when dementia was just starting to rear its ugly head, and it was a one and done. I saw the charge immediately, and was able to call the company to verify what she had ordered. Since it was the right size, a decent price and a logical purchase for her, I let it go through. It was a simple lesson for me that the credit card needed to be monitored on a regular basis. I got lucky.

What Are Your Rights?

Lacking mental capability

With a reputable company, your situation can usually be resolved with a simple phone call, during which time you can let them know that your loved one suffers from dementia and lacks the mental capacity to make financial decisions. Unless the person or company is truly trying to be deceptive, this will generally be accepted.

We are back to that Power of Attorney

How many times have we come back to this extremely important document since I started the blog? Your best defense against any type of scammer or opportunist is going to be your ability to speak and act on your loved one’s behalf. Without the Power of Attorney, it is only having a good conscience that will keep these people honest…and they don’t have a conscience. Don’t be afraid to invoke the powers of this legal document when you need to protect your loved one.

Don’t be afraid to threaten!

If you truly can’t resolve the matter using common sense and good communication, threaten them. There are several governmental agencies that deal directly with abuses to the elderly, and a quick call to them should help you out of a sticky situation. If you really need it, consult an eldercare specialist attorney, who can work with you to resolve these issues.

Overall

Scamming the elderly. This is definitely a topic that requires vigilance and consistency to help your loved one avoid problems with scammers, opportunists, and companies that target lonely and isolated senior citizens. It is important that you always know what your loved one is watching, reading and absorbing. Combine that with your watchful eye on their finances and credit cards, and hopefully you will be able to avoid the worst of these schemes.

If not, use technology to find yourself a lawyer.

THANK YOU FOR READING THIS FAR

Wow! You made it! Thank you for reading about scamming the elderly!

Hey, since you’re here! You may as well check out part 1 of my Mother-In-Law story, here, or if you’ve read that, check out part 2, here! Or maybe you want to hear more about Pop, here. Or, check out our other topics here! Either way, I appreciate you!

Please leave a COMMENT about any tips you may have!! Or comment with YOUR story! Any dementia stories? Let me know!

Please, feel free to contact me or leave a COMMENT with anything you would like to hear more about! Or reach out with any unrelated questions, comments, concerns, or random outbursts of excitement by clicking here.

Oh! And don’t forget to check out my video series by CLICKING HERE!!!

Wow you really packed a lot of great information in this article. Thanks

Thank you!